FICO Scores (What YOU Need to Know)

You’ve probably never heard of the Fair Isaac Corporation, but it’s heard of you. And it rules much of your life, from your mortgage’s interest rate to your ability to land a job.

That’s because Fair Isaac invented the FICO score, a number used by potential lenders to evaluate your creditworthiness. Since the early ’90s, this credit score has affected the financial lives of countless people across the United States. And you don’t have just one score, either; you have dozens, including multiple FICO scores.

Since they probably won’t go away any time soon, you should understand your FICO scores in and out. Below, we’ll review what you need to know about credit scores, or you can skip straight to the information about where to get your free FICO scores.

What is a Credit Score

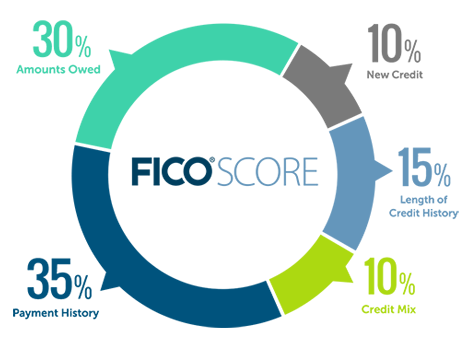

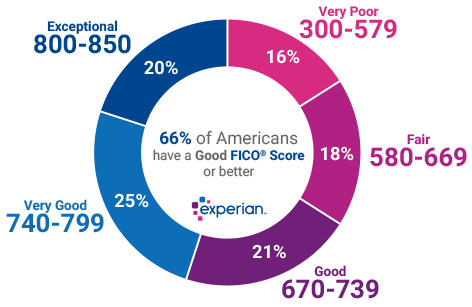

A credit score is a number (usually between 300 and 850) that helps lenders evaluate how likely you are to pay back a loan. Though the exact formula is a secret, it’s based on your credit history and current credit information (like how many cards you have open and whether or not they’re maxed out).

The national average FICO score is 700, which falls just into the range of “good” credit scores.

How to Improve Your Credit Scores

Unhappy with your FICO credit scores? Here are a few ways you can improve them:

1. Pay off debt: One of the key factors in your credit scores is how much of your available credit you're using. This is called your credit utilization ratio, and the lower it is, the better.

2. Keep old cards open: Though it might seem counterintuitive, you don't want to close out a credit card once you pay it off. In addition to increasing your credit utilization ratio, it'll also lower the average age of your accounts. A longer credit history — and higher average age — will help your scores go up.

3. Make all your payments on time: Payment history is super important to your credit scores. If you have trouble remembering your due dates, set up automatic withdrawals or create calendar reminders. Learn when and how much you should pay here.

4. Check your scores regularly: If you've learned one thing from this article, we hope it's to check your credit scores and reports at least once per year, or more often if you're applying for new credit. Not only will you catch errors, you'll also be able to spot signs of identity theft.

Trust us when we say the positive effects will ripple throughout your entire life.

Link to original article from Credit Card Insider